Georgia Tax Refund 2025

Georgia Tax Refund 2025. Head of household filers could receive a maximum refund of. Gtc provides online access and can send notifications such as when a refund has been issued.

So much so that most resident taxpayers are getting an extra, automatic refund. Calculate your annual salary after tax using the online georgia tax calculator, updated with the 2024 income tax rates in georgia.

Atlanta (Ap) — Georgians Will Owe Less In Income Taxes This Year And Will Get A Chance In November To.

1%, 2%, 3%, 4%, 5% and 5.75%.

This Tax Return And Refund Estimator Is For Tax Year 2025 And Currently Based On 2024/2025 Tax Year Tax Tables.

Utah tax changes effective july 1, 2024.

Aligns The State’s Corporate Income Tax Rate To Its Personal Income Tax Rate, Reducing It To 5.39% From.

Images References :

Source: news.yahoo.com

Source: news.yahoo.com

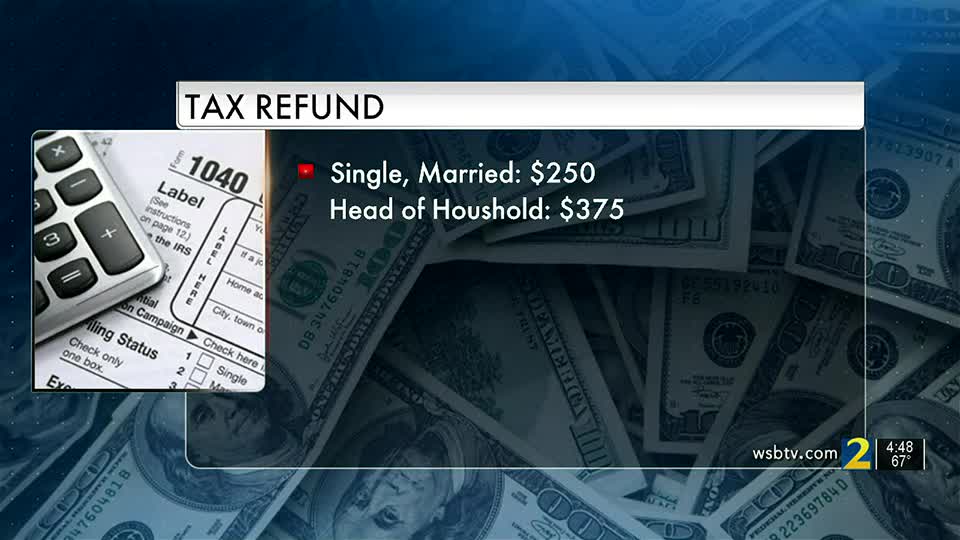

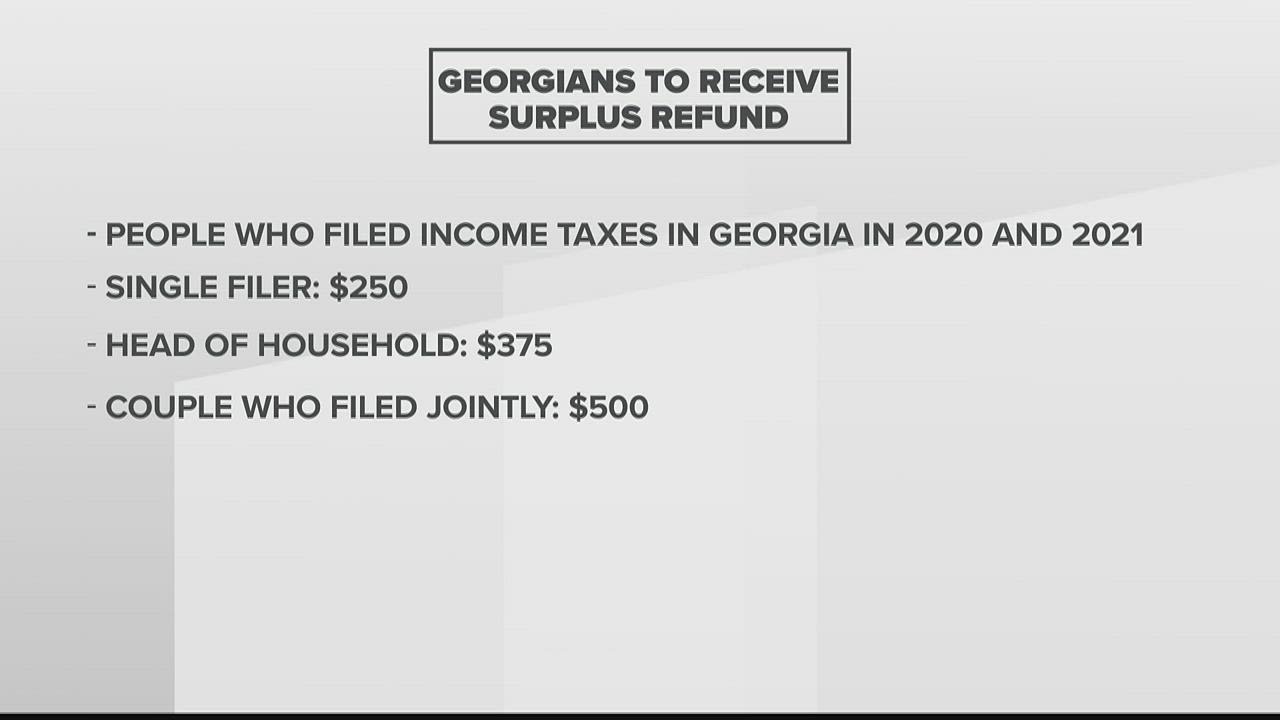

tax refund What to know about extra state tax refund, So much so that most resident taxpayers are getting an extra, automatic refund. As soon as new 2025 relevant tax year data has been.

Source: www.youtube.com

Source: www.youtube.com

Update on when surplus tax refunds will start arriving YouTube, Looking for your 2023 surplus tax refund? So much so that most resident taxpayers are getting an extra, automatic refund.

Source: www.youtube.com

Source: www.youtube.com

What is the special tax refund? YouTube, You can quickly estimate your georgia state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. The office of planning and budget estimates savings for georgia taxpayers of approximately $1.1 billion in calendar year 2024 as a result of the tax cut acceleration.

Source: blog-pfm.imf.org

Source: blog-pfm.imf.org

Implementation of a Single Tax Code in, For 2023 (tax returns filed in 2024), georgia had six state income tax rates: This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables.

Source: expathub.ge

Source: expathub.ge

Will You need To File An Annual Tax Return In ExpatHub.ge, Georgia now joins iowa and. Kemp signed hb 162 into law yesterday, providing for a special state income tax refund for georgians who filed returns in both.

Source: www.dochub.com

Source: www.dochub.com

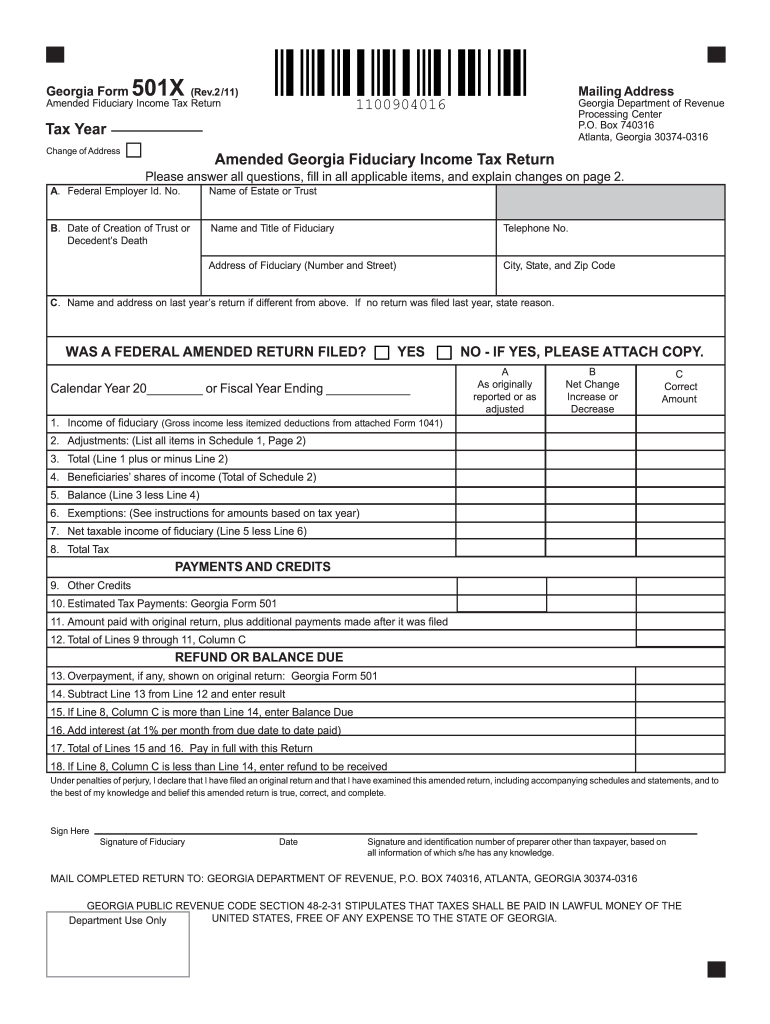

tax return Fill out & sign online DocHub, Calculate your annual salary after tax using the online georgia tax calculator, updated with the 2024 income tax rates in georgia. Kemp signed hb 162 into law yesterday, providing for a special state income tax refund for georgians who filed returns in both.

Source: abundantreturnstaxsvc.com

Source: abundantreturnstaxsvc.com

Tax Refund by Abundant Returns Tax Service in Atlanta GA, Reduces the flat personal income tax rate from 5.49% to 5.39%.; 2023 georgia state income tax rates and tax brackets.

Source: printableformsfree.com

Source: printableformsfree.com

Ga State Refund Cycle Chart 2023 Printable Forms Free Online, (the center square) — several tax changes took effect on monday, the start of fiscal 2025, including a decrease in. Information regarding georgia income tax, business tax, property tax and many other tax laws and regulations.

Source: dor.georgia.gov

Source: dor.georgia.gov

Department of Revenue, You can quickly estimate your georgia state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. Head of household filers could receive a maximum refund of.

Source: georgiaguardfamily.org

Source: georgiaguardfamily.org

Taxpayers! “Pick an Amount & Make it Count” for the GA National, The office of planning and budget estimates savings for georgia taxpayers of approximately $1.1 billion in calendar year 2024 as a result of the tax cut acceleration. Calculate your income tax, social security and.

Georgia State Income Tax Rate For Current Tax Year:

Check your refund online (does not require a login) sign up for georgia tax center (gtc) account.

Looking For Your 2023 Surplus Tax Refund?

Use the automated telephone service at 877.