Md County Tax Rates 2024

Md County Tax Rates 2024. There will be 97 early. Combined with the state sales tax, the highest sales tax rate in maryland is 6% in the cities of baltimore, silver spring, hyattsville, gaithersburg and rockville (and 446 other.

Montgomery county collects, on average, 0.76% of. 28 rows the local tax rates for calendar year 2024 are as follows:

Early Voting For The Primary Election Runs Thursday, May 2, Through Thursday, May 9.

Anne arundel county local income tax rates will be as follows for 2024:

First, We Calculate Your Adjusted Gross Income (Agi) By Taking Your Total Household Income And Reducing It By Certain Items Such As Contributions To Your 401 (K).

5, while state withholding methods were.

Total Income Expected In 2024:

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, .0270 of maryland taxable income of $1 through $50,000; Early voting locations will be open from 7 a.m.

Source: kayqdarelle.pages.dev

Source: kayqdarelle.pages.dev

2024 Tax Brackets And How They Work Ericka Stephi, 2.5698 1.2000 1.7000 1.7050 2021: Vacant land located at 1570 meyers station rd, odenton, md 21113 sold for $370,000 on apr 30, 2024.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, 28 rows the local tax rates for calendar year 2024 are as follows: Combined with the state sales tax, the highest sales tax rate in maryland is 6% in the cities of baltimore, silver spring, hyattsville, gaithersburg and rockville (and 446 other.

Source: infogram.com

Source: infogram.com

Maryland property tax bills by county Infogram, 26, 2024, 2:26 pm pst. Vacant land located at 1570 meyers station rd, odenton, md 21113 sold for $370,000 on apr 30, 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The median property tax in maryland is $2,774.00 per year for a home worth the median value of $318,600.00. .0270 of maryland taxable income of $1 through $50,000;

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, Maryland income tax brackets 2024. The 2024 tax rates and thresholds for both the maryland state tax tables and federal tax tables are comprehensively integrated into the maryland tax calculator for 2024.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Look up 2024 maryland sales tax rates in an easy to navigate table listed by county and city. Three maryland counties changed their income tax rates for tax year 2024, the state comptroller’s office said jan.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Annual Tax Table 2024 Lily Shelbi, The 2024 tax rates and thresholds for both the maryland state tax tables and federal tax tables are comprehensively integrated into the maryland tax calculator for 2024. Total income expected in 2024:

Source: upstatetaxp.com

Source: upstatetaxp.com

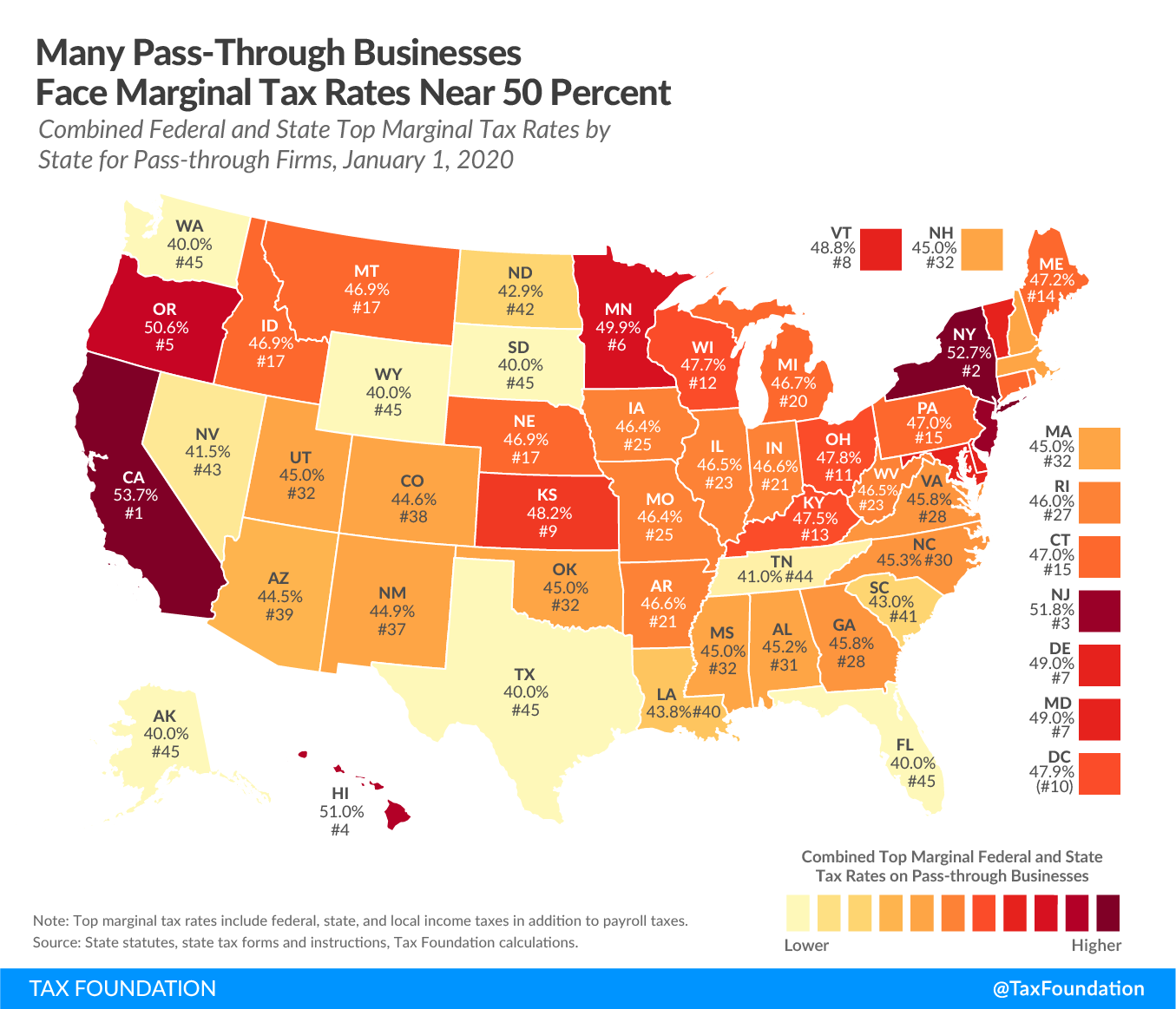

Marginal Tax Rates for Passthrough Businesses by State Upstate Tax, First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such as contributions to your 401 (k). 5, while state withholding methods were.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, For taxpayers with a filing status of single, married filing separately or dependent: Is an independent website, and we rely on ad revenue to keep our site running and our information free.

Is An Independent Website, And We Rely On Ad Revenue To Keep Our Site Running And Our Information Free.

The 2024 tax rates and thresholds for both the maryland state tax tables and federal tax tables are comprehensively integrated into the maryland tax calculator for 2024.

Choose A Specific Income Tax Year To See The Maryland Income Tax Rates And Personal Allowances Used In The Associated Income Tax Calculator For The Same Tax Year.

Combined with the state sales tax, the highest sales tax rate in maryland is 6% in the cities of baltimore, silver spring, hyattsville, gaithersburg and rockville (and 446 other.